Last month, the George Weah administration submitted its draft budget for fiscal year 2018 / 2019 to the legislature. The budget must move through the legislature before it’s finalized. However, we can learn a lot about an administration’s priorities by looking at its budget, even at this point in the process. What story do the numbers tell?

Projected Revenues

The budget is based on projections that put estimated revenue at $562.2 million (USD). This represents about a 5 percent increase over last year’s approved budget. The projected revenue comes from:

- Tax revenue (72 percent) — This includes revenue from income and profit taxes, real property taxes, goods and services taxes, international trade, and other areas such as agriculture and mining taxes.

- Non-tax revenue (17 percent) — This includes revenue from property income, dividends, royalties and rents, mineral mining, forestry, cellular mobile networks, fines, penalties, and forfeits, administrative fees, and domestic borrowing.

- Grants (9 percent) and Loans (2 percent) — This includes grants from foreign governments and international organizations as well as external financing via Central Bank of Liberia.

Here’s how all the above breaks down into actual numbers:

- US$549,526,000 core revenue — This is the projected tax, non-tax, and grant revenues.

- US$12,628,000 “contingency†revenue — This is money that must be borrowed to make up a shortfall between projected revenues and projected expenditures. In other words, in order to balance the budget, the administration proposes to borrow more than US$12.6 million.

Projected Expenditures

The budget breaks Liberia’s expenditures into two categories:

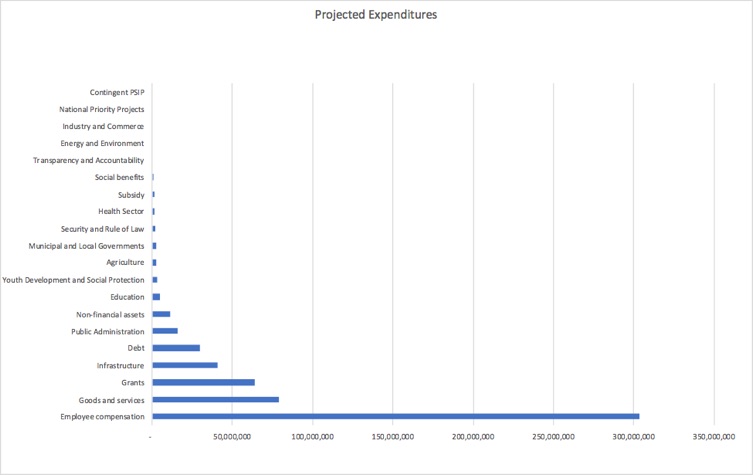

- US$488.8 million in “recurrent†expenses — Recurring expenses are those that occur every year for the ongoing operations of the government. This year’s draft budget’s recurrent expenses include: employee compensation (US$303.4 million, representing more than half of the entire budget and 62 percent of the government of Liberia’s recurrent expenses), goods and services (US$78.9 million), grants (US$63.9 million), non-financial assets (US$11 million), social benefits (US$0.48 million), debt (US$30 million), and subsidy (US$1.5 million).

- US$73.4 million in “Public Sector Investment Plan†(PSIP) expenses — Representing 13 percent of the budget, these funds are earmarked for public sector projects in health, education, agriculture, infrastructure and social development.

Of the US$73.4 million in public sector investment plan expenditures, which pales in comparison to employee compensation, most of the investments barely appear as a blip on the bar chart. The health sector, for example, has just US$1,580,000 PSIP funds allocated.

The chart below illustrates public sector priorities based on allocated funds.

The chart above represents funding for public sector programs. While Liberia absolutely must invest in infrastructure, agriculture, education, health care, and all of the above, these programs are barely funded compared to Liberia’s recurrent “business as usual†expenses.

To better visualize the administration’s priorities in the proposed budget, let’s take a look at the recurrent and PSIP numbers in a chart:

Employee Compensation

Clearly, the largest portion of the budget is dedicated to employee compensation. It’s worth noting that nearly a quarter of Liberia’s workforce works for the government, so, naturally, you’d expect employee compensation to be a large number. That number may even be larger. According to the 2014 Update: Republic of Liberia Medium-Term Pay Reform Strategy document, “…an unknown number of individuals in government bodies are ‘hired’ informally and paid off payroll via general allowances, petty cash or other sources.â€

As outrageous as it is to discover that health care, education, and youth development barely register as national PSIP priorities, one can’t help but wonder if it’s really necessary to devote more than half of the national budget to employee compensation?

The 548-page draft budget document notes that employee compensation has decreased by 1.4 percent due to the implementation of a compensation reduction scheme, but is that enough? Earlier this month, Abraham Darius Dillon, the opposition Liberty Party’s assistant chairman for political affairs, suggested that government payroll had actually increased from US$280 million under the last regime.

Expenditures by Sector

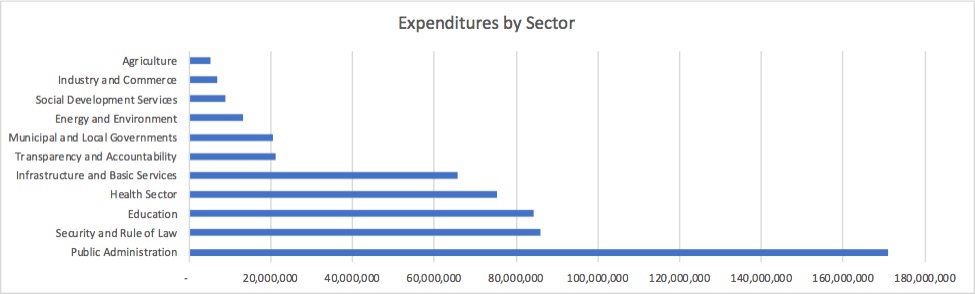

To be fair, the government’s projected expenditures are broken across various sectors. For example, government employees work in different areas such as public administration, health care, education, energy, waste management, and so on. Likewise, investments in non-financial assets such as machinery or vehicles occur across all areas of government.

Thus, even though we may only see a tiny Public Sector Investment Plan allotment for a given sector, that doesn’t mean that’s it for the entire sector.

The draft budget includes sector-specific breakdowns. Here’s how the US$562.2 million is split amongst the various public sectors.

What about President Weah’s Commitment to Agriculture?

Remember then-presidential candidate Weah promising to prioritize agriculture last year? He promoted agriculture as a means to boost Liberia’s economy, empower its people, and help make the country self-sufficient — yet, agriculture represents a mere one percent of the total budget.

What’s Next?

Each year, the executive branch prepares the draft budget and sends it to the legislature. Now, it will be dissected, debated, and changed before being passed into law for fiscal year 2018 / 2019, which begins July 1st. Whether you’re happy with the draft budget or would like to see the Liberia government rethink some of its priorities, consider getting involved. Public discussions typically take place at the National Legislature once the draft budget has been received.