GANTA, Nimba – The Central Bank of Liberia is conducting a four-day seminar for rural community financial institutions in Ganta.

The occasion is the second of its kind, bringing together rural community financial institutions, known as RCFIs, from around Liberia face-to-face with the Central Bank to discuss the many challenges the institutions face.

The event officially kicked off at the Guinea Embassy Hall in Ganta on Monday, December 11. Central Bank Governor Milton A. Weeks provided the overview of the gathering, terming it as “an important event†meant to demonstrate the bank’s assurance and commitment to the existence of the institutions.

The event is also expected to be marked by special training sessions, with topics focused on the Central Bank’s regulatory framework, supervisory standards, and the role of the bank in the financial sector.

Many RCFIs were established in 2009 as an alternative delivery channel to provide access to finance for those living in rural Liberia.

Weeks acknowledged that making RCFIs more sustainable and viable is important, “as the Central Bank of Liberia believes that the RCFIs can play a part in the economic development of Liberia.â€

The RCFIs are fully functional in Nimba, Lofa, Bong, River Cess, River Gee, Gbarpolu, Sinoe, and Grand Kru.

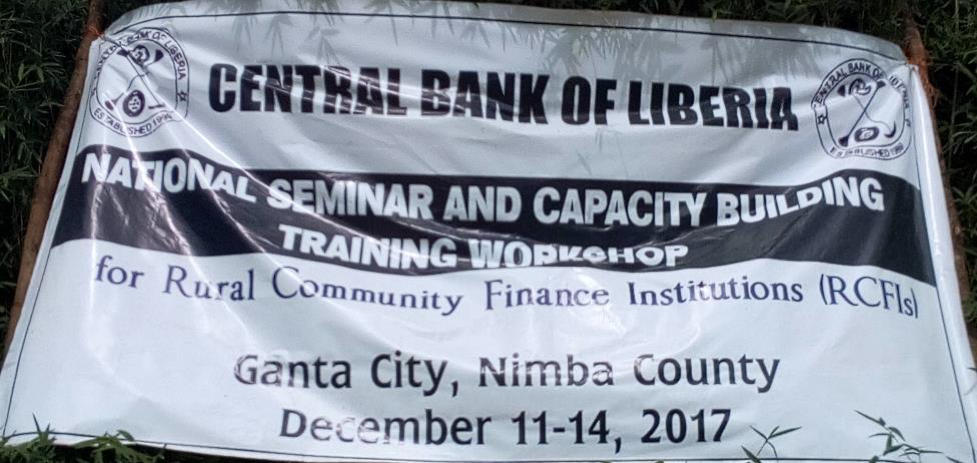

Participants at day two of the seminar. Photo: Arrington Ballah

Meanwhile, the Director of Regulations and Supervision addressed the increasingly harsh economic climate, especially for traders who work primarily with the Liberian dollar. Musa Kamara attributed the increasingly unfavorable rate of the Liberian dollar against the U.S. dollar to the decrease in the export of basic commodities. In rural parts of Liberia, one U.S. dollar can be bought at L$127-130.

Kamara said prices have decreased for Liberia’s primary exports – iron ore and rubber – which has limited access to foreign currency. He added that “everything we need in Liberia, needs foreign currency.â€

Kamara noted that Liberia’s exchange rate has increased by 100 percent compared to four years ago, insisting that Liberians need to reduce their dependence on imports by growing their own food.

Featured photo by Arrington Ballah