MONROVIA, Montserrado – After the first meeting between the government and money exchangers ended in a deadlock, the Economic Management Team says it has agreed to permit street vendors and scratch card dealers to conduct foreign exchange operations.

The first meeting had attempted to find a solution to the fast-rising exchange rate of the Liberian dollar to the U.S. dollar.

A Central Bank of Liberia press statement dated August 1 said the bank is now considering establishing a new category of license for street vendors – Category C. The street vendors will also be given until September 30 to obtain their official business registrations.

The Central Bank said the new decision was intended to align the organization with the policy measures introduced on July 18 to address the depreciation of the Liberian dollar against the U.S. dollar.

Those policies included that all licensed foreign exchange bureaus are required to submit their monthly returns as prescribed by the Central Bank, reflecting the monthly purchases and sales of foreign exchange currencies in line with the forex exchange bureau regulations.

In addition, all licensed bureaus will be required to declare their operational funds to the Central Bank in both Liberian and U.S. dollars on a weekly basis.

When the Central Bank initially made the announcement, many money changers were infuriated with the new demands. The major objection to the new policies was a requirement that street vendors would not be permitted to sell scratch cards while changing money. Additionally, capital requirements were also hefty. The Bank had said it would only allow registered foreign exchange bureaus to exchange money. However, the costs of registering would have been overwhelming for street vendors and would have pushed most of them out of business.

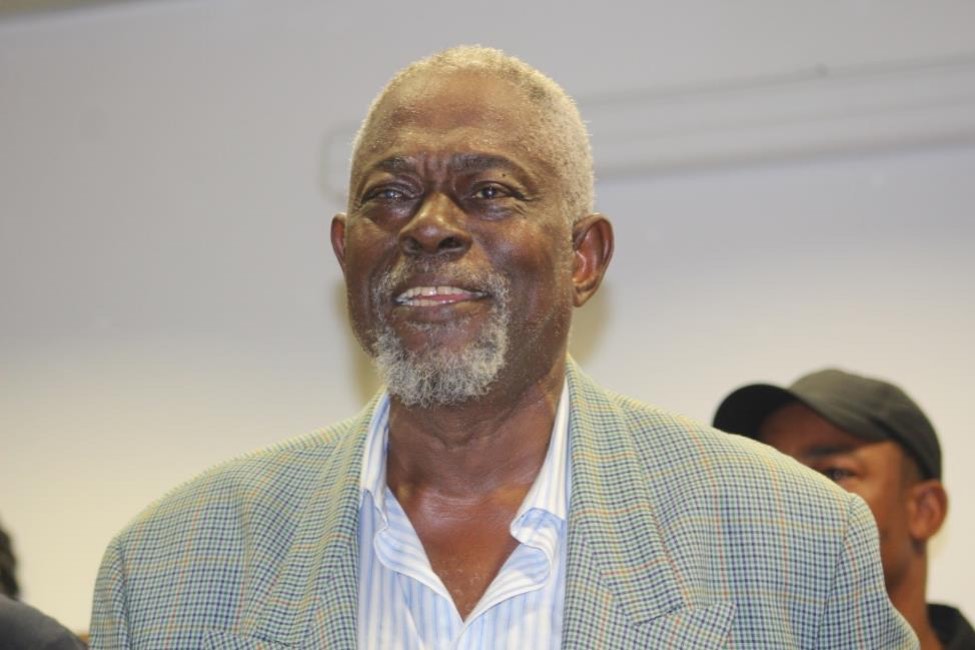

One of those street vendors, Ridso Duo, who changes money on Broad Street, spoke after Central Bank governor Nathaniel Patray announced the regulations on July 18.

“How does the CBL governor designate expect me to pay US$1,250 as a minimum capital requirement when my capital is only US$300,†he said.

Ridso Duo, money changer on Broad Street. Photo: Zeze Ballah

“Most of us are self-supported and are in the business to sustain ourselves because of the lack of jobs in the country,†he said.

As a student of Stella Maris Polytechnic, Duo said the government’s plan would put him and others out of business.

“My brother, where am I going to get US$1,250 as minimum capital requirement to establish a forex exchange bureau?†he asked.

The Category C license being proposed is now expected to accommodate street vendors.

Effective October 1, the press statement said the Bank would start conducting monitoring exercises to weed out unlicensed scratch card dealers, minimize speculations, and ensure compliance.

Meanwhile, the press statement said the street vendors have also agreed to desist from posting exchange rates on placards in the streets, although “foreign exchange rates shall be conspicuously displayed inside the foreign bureaus using the same rates as licensed foreign exchange bureaus.â€

“The CBL will soon sign a Memorandum of Understanding with the National Street Vendors and Scratch Cards Dealers formalizing said agreement and the terms expressed herein takes immediate effect,†the press statement concluded.

Featured photo by Zeze Ballah