MONROVIA, Montserrado – The legislature has begun hearings for the 2020/2021 budget.

The Joint Committee on Ways, Means, Finance, and Public Accounts began hearings on Monday, August 9 with the revenue components of the budget held behind closed doors with representatives from the Liberia Revenue Authority and the Ministry of Finance and Development Planning. Hearings with the Liberia Telecommunications Authority, the Liberia Maritime Authority, the Liberia Petroleum Refining Company, the National Port Authority, and the National Fisheries and Aquaculture Authority took place on Tuesday.

Rep. Thomas Fallah of Montserrado’s fifth district, who chairs the joint committee, said the process would last for a few days and he promised that it would be speedy.

Although Finance Minister Samuel Tweah was not present, the deputy minister for fiscal affairs, Samora Wolokolie, represented the Finance Ministry. Wolokolie noted that domestic revenues accounted for 76 percent of the US$535.4 million projected for the 2020/2021 fiscal year. The rest constitutes external resources.

Wolokollie further noted that 70 percent of the domestic revenues collected were expected to come in United States dollars, while the remaining amount with a value of US$122.1 million was expected to be collected in Liberian dollars.

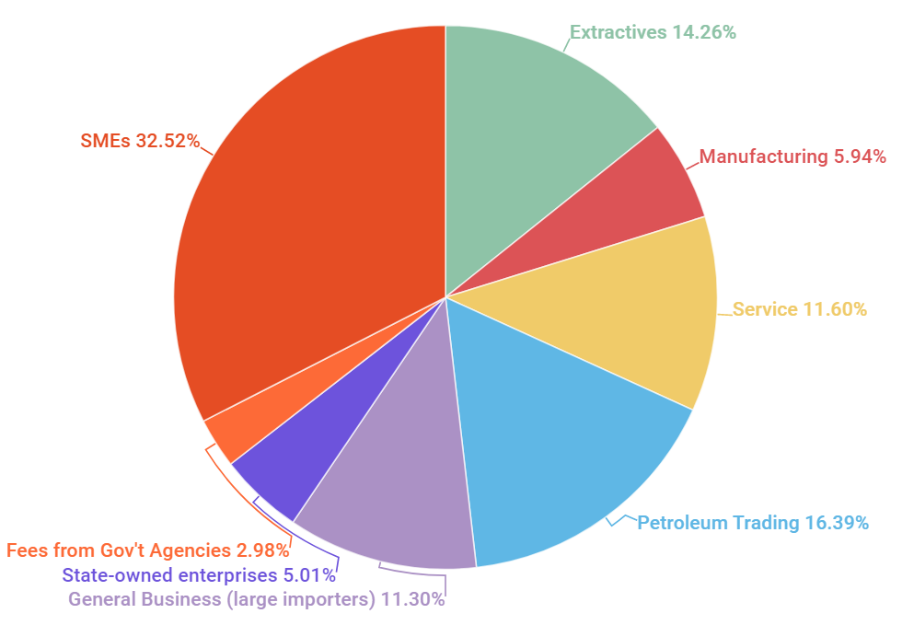

A breakdown of the US$407.4 million projected domestic revenues.

Wolokolie also projected revenues from the extractives sector (agriculture, forestry, and mining) to be at US$56.9 million, with agriculture accounting for US$13.1 million, mining accounting for US$39.7 million, and forestry US$4.1 million.

Revenues collected from small and medium enterprises in the form of taxes on real property, motor vehicles, and importation of goods by individuals and small firms are expected to account for the bulk of all domestic revenues, according to the deputy finance minister, with US$129.8 million projected, or 32.52 percent of all domestic revenues.

According to Wolokolie, revenues from the external resources would come in the form of grants and loans and total US$118 million, with grants accounting for US$47.5 million and loans accounting for US$70.5 million.

Speaking further, Wolokolie added that the Finance Ministry was requesting “new sets of measures put in place to improve tax policy and administration.” Those included additional duties on petroleum products and a one-percent increase on the Goods and Services Tax, which already hovers between 7 and 10 percent depending on the product. He noted that these proposals and others would later be submitted to the legislature.

Featured photo by Zeze Ballah