MONROVIA, Montserrado – President George Weah has disclosed that Liberia’s total public debt has now exceeded US$1.27 billion due largely to investments in infrastructural projects.

Speaking at his third State of the Nation Address before a joint session of both houses of the legislature at the Capitol Building on Monday, Jan. 27, Weah informed the nation of the US$1.27 billion debt, which represents an increase of US$282 million (or 28.5 percent) over previous debt level of US$987.8 million at the end of 2018. Of this amount, US$419.8 million represents domestic debt, while external debts amount to US$849.99 million.

“The government’s public debt has increased, largely because the country has had to finance major infrastructure projects over the last several years,†the president said.

Foreign debt increase has been the result of recent disbursements by the World Bank, the African Development Bank, International Fund for Agricultural Development, Saudi Development Fund, and other creditors, the president said, totaling some US$129.5 million, and accrued mainly through loans contracted and ratified during the administration of President Ellen Johnson Sirleaf.

A significant part of domestic debt has also been the result of the government’s crediting from the Central Bank in the tone of US$487 million as of Jan. 2020. But according to Weah, only 7.8 percent of this amount (US$38 million) represents borrowing done by his administration in the last two fiscal years. The balance of US$449 million represents debt brought forward from the previous administration.

The president devoted a significant segment of his Annual Address to the issues of national debt and borrowing. This is, in part, due to its significance as a benchmark fulfillment in the government’s economic recovery program with the IMF.

The government, according to the president, has now fully reconciled and rationalized all its obligations to the Central Bank under the agreement with the IMF; and has agreed “to pay interest at the rate of four percent per annum to the central bank on the principal amount owed, with a grace period of 10 years on principal payment.â€

The increase in the nation’s debt stock has also been the result of the administration’s effort to consolidate accrued obligations by state-owned enterprises, as well as adjust liabilities to NASSCORP and seven commercial banks – LBDI, Afriland Bank, Ecobank, IB Bank, UBA, GN Bank and GT Bank – totaling US$118.5 million.

Part of the government’s debts to commercial banks is a long-standing obligation of US$65.2 million resulting from pre-financing of the government’s Heavy Fuel Oil infrastructure projects, the government’s guarantee to the Rubber Planters Association of Liberia in 2014, and loans given to companies for pre-financing of various government infrastructure projects.

Late last year, the government received assistance from the Africa Export Import Bank through a bond discount facility which facilitated the disbursement of US$52 million to commercial banks as settlement of the US$65.2 million owed by the government. Excluded from this domestic debt relief, however, was any payment to vendors and businesses who supplied goods and services to the government over the years.

“I am reliably informed that, as far back as 2006, the Government of Liberia conducted an audit of domestic debt owed to vendors. Yet, up to today, this situation remains unclear,†he said.

“Unless domestic revenue significantly improves, meeting the debt service obligations will remain a challenge.â€

This uncertainty expressed by the president assumes an even greater significance in light of the fact that the 5-year grace period of most of the government’s external debts will elapse by next year, and principal payments will become due.

Total estimated debt servicing for fiscal year 2019/2020 is projected at US$65 million and will increase to US$98 million the following fiscal year. This reality is expected to significantly limit the administration’s ability to undertake new borrowing needed to finance continued public and private sector investments.

In order to both sustain economic prospects and adhere to agreed-upon benchmarks under the IMF-supported program, the government will be constrained to keep within the limits of its non-concessional borrowing space, and work towards public-private financing for additional public investments, the president disclosed.

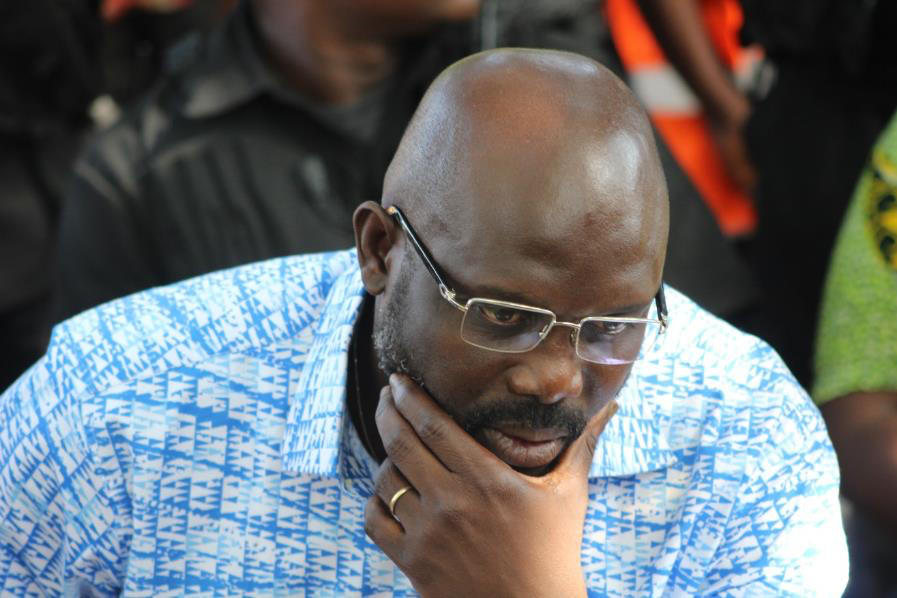

Featured photo by Zeze Ballah